The term ‘commercial mortgages’ is a wrapper for number of different property related finance products. As a business we use it to describe a large amount of the work that we do for clients – and the industry commonly uses this terminology.

The trouble with a single header for multiple products – all of which are quite different in the requirements that they meet – is that in the end the header becomes a bit like an acronym – and you can’t remember what it actually means!

It can be confusing that when we say ‘mortgages’ we are actually also including short-term finance products; in this sense ‘mortgages’ refers to the fact that all of these products are all secured on property.

So when Fiducia Commercial Solutions says ‘commercial mortgages’ what do we actually mean? And who can use them? Oh, and what are they?

Commercial Mortgages:

Commercial mortgages are used to fund the purchase, or refinance of, commercial, semi-commercial or residential properties – and as we explain below the funding reason can be both to occupy the building, and as an investment.

In general terms there are 3 main uses for commercial mortgages:

- Owner-Occupier: The purchase or refinance of the property where your company is currently trading, or the purchase of a new property to move to and trade from

- Commercial Investment: The purchase or refinance of commercial or semi-commercial property that will be rented to another company to trade from – essentially a commercial Buy-To-Let investment

- Residential Buy To Let: An individual or a limited company (‘SPV’ or Special Purpose Vehicle) can purchase residential property to let as an investment, and professional landlords / Buy-To-Let limited companies use these mortgages for the same purposes

In case you were wondering, residential properties are all part of the day job for Commercial Finance brokers! Just wanted to throw that out there – as it does seem a bit of an oxymoron!

Easy assumption is that all we would look at is commercial buildings – shops, offices, pubs, restaurants, factories etc. But the ‘commercial’ applies to the purpose, not the property.

Commercial mortgages are, just like residential consumer mortgages, available with fixed or variable interest rates over a range of years, and the amount that you can borrow is set as a ‘Loan To Value’ (LTV) percentage of the property value.

Existing property holdings with equity value in them may be considered towards the deposit by some lenders as security.

Affordability, Affordability, Affordability!

The amount that you will be expected to

have a deposit can vary according to different factors, including:

- If you are a commercial

owner-occupier: the sector that you are in / your company’s recent financial

performance / they type of property you are financing

- If you are a commercial

investor: the type of property you are financing / the sector that your tenants

are in / the amount of revenue generated from the lease/s

- If you are a residential investor: commonly come with a higher LTV than commercial property; affordability driven by valuer’s confirmation of the achievable market rent, which is stress tested against mortgage payments

We want to cut through the acronyms and smoke and mirrors to show that far from being some sort of ‘dark arts’, lenders use the same process to evaluate your business as we all might do our own personal finances.

With investment mortgages the maths is relatively straightforward; you will have a commercial lease or residential tenancy agreement in place with your tenant and the lender will ‘stress’ your mortgage with simulations of interest rate rises to ensure that even if rates were to rise from their current levels then the rental income still makes the mortgage payments affordable.

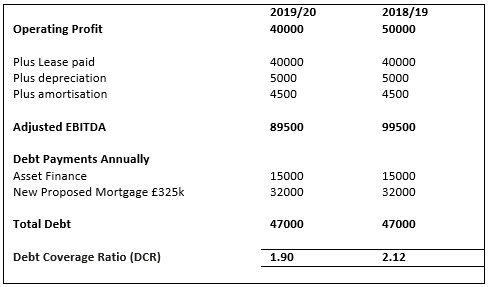

Commercial Mortgages for trading businesses have far more moving parts, as affordability is based on the future trading performance of the business.

In the absence of a crystal ball the lender has to use past performance as a guide to whether your business can service the mortgage moving forward.

Again we can draw a similarity here with a personal mortgage application – your prospective lender would want to know all about your income, together with the other debt and outgoings that you have to service regularly. From this they will derive how much ‘headroom’ you have in your finances to be able to afford the mortgage.

Bridging Finance:

This effectively does what the name suggests – bridges the gap from one point to another in a financial sense, and are a short-term property finance product, between 3-24 months in term, but the ‘common’ term is 12 months.

At the end of the loan the ‘exit’ from the loan for your company is the repayment of the loan from the disposal of the property, or ‘re-financing the bridge’ with a long-term finance product.

Bridging loans can provide a quick route to property purchase, and are commonly used to purchase property at auction and for circumstances when the normal conveyancing cycle would take too long to complete the purchase in the required time frame.

Bridging is a means to refurbish commercial or residential property, or funds to develop property – from light / cosmetic refurbishment of existing structures to ground up development of land.

‘Just’ for property transactions? Well, no.

Bridging is of course based on property as the security for the loan, but the business reason could be to release equity from a property already held by a business or director. Therefore it could be said that bridging finance is a cash flow tool for raising working capital too.

Given the specialist and short-term nature of bridging loans, interest rates can be higher than traditional commercial mortgages.

Development Finance:

On the surface a complex area of finance – but you can start to lift the lid on its application for you and your business by looking at the amount of structural work that is required on your project.

Finance terms that are available to you

vary according to:

- the initial value of the

property / land (Purchase Price)

- the costs and fees associated

with the development work (Cost Of Works)

- the projected value of the completed

development (Gross Development Value)

- your previous experience of development

Commonly used terms for variants of

development:

- Light Refurbishment: Cosmetic

refurbishment with no structural changes. Includes: Kitchens, Bathrooms,

Windows, Doors, Decoration and modernisation

- Heavy Refurbishment: Contains cosmetic

work, but usually renovation work including structural changes (internal walls)

or changes to the footprint of the property

- Ground Up Development: Commonly starts from vacant land, can include demolition and rebuild projects

Lenders are likely to look for projects

where planning permission is already granted, even if you might vary that once

you have acquired the site.

So it is worth your knowing that ‘commercial mortgages’ isn’t a header for a single product – and there is no ‘one size fits all’ solution.

But that is where a commercial finance broker can add so much value to you – we can listen to your full requirements and match you with the most suitable lender and product from our large ‘whole of market’ panel of lenders.

We do the legwork so that you don’t have to – how do you want to put the roof over your business or investment?

Mark Grant, February 2022.